Eze Marketplace Partner: Omega Point

Turn data into decisions. Omega Point is a comprehensive front-office risk management and portfolio construction solution, allowing customers to efficiently identify portfolio exposures and risks and take action through improvements in portfolio construction. The open ecosystem streamlines access to key datasets and fintech tools, thereby boosting the efficiency of investors' risk, portfolio management, and research teams without needing development or data science teams.

Key Benefits

- Identify key drivers of portfolio performance, underlying exposures, & security contributors

- Respond to investors with confidence by explaining with clarity the hidden forces that are acting on the portfolio

- Access to leading factor datasets and interactive tools that visualize how your portfolio is positioned against current market conditions, monitoring the portfolio’s net exposures & risks to these factors

- Adopt responsive and repeatable data-driven processes into existing investment workflows, reducing time to answer questions to seconds

- Evaluate the risk-adjusted efficiency of your capital deployment for total, sector, and factor bets

- Easily overlay factor exposures from leading financial datasets

- Access quant-enabled portfolio construction tools, including risk-enabled trade simulations, portfolio rebalance, ETF replacement, and custom basket creation workflows

Key Features

- Enjoy interactive asset and portfolio analysis with factor attribution breakdown

- Analyze performance and factor exposure as well as risk trends to evaluate how the dynamic interplay of portfolio + market has played out on your portfolio

- View portfolio, position, and standalone security level factor trends with out-of-range alerts

- Match certain factor characteristics with an interactive screening and research tool that instantly finds new securities

- A highly visual interface enables quick communication to investors and clients on how your portfolio has been impacted by any unwanted factor

- Intuitive slicing-dicing tools enable analysis and evaluation of any segment in your portfolio as well as instant re-calculations for category/tag analysis

- Add an exposure overlay to any security, category, or portfolio

- Use a trade simulator to isolate fundamental views by adjusting individual position sizes while receiving instant feedback on the impact of these trades on the portfolio’s risk profile

- Construct more precise hedge baskets using any target universe & specific criteria to offset targeted exposures

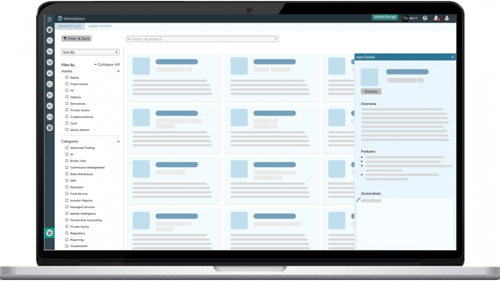

Are You Looking to Become a Marketplace Partner?

Powered by a secure, real-time data sharing architecture, the Eze Marketplace framework enables developers to build solutions that are deeply embedded and interact directly with SS&C Eze platforms. Share your solutions with thousands of buy-side users on Eze Marketplace. Contact us to learn more.